When Sales Look Good but Cash Feels Tight

The last couple of months we have noticed that cash flow has been tighter than usual. On paper, looking at our Profit and Loss on an accrual basis, it shows we are in the green. Enough invoiced work is flowing through to cover everything.

But when I flip the Profit and Loss into cash basis, which is what is actually hitting the bank, the picture changes. Suddenly you can see the timing of cash in and cash out across the month.

And here is the kicker. The last couple of months we have actually gone backwards. One month we had about $8k more going out than coming in, the next it was about $9k. Meanwhile, the accrual Profit and Loss still looked healthy because the work is there, it just has not been paid yet.

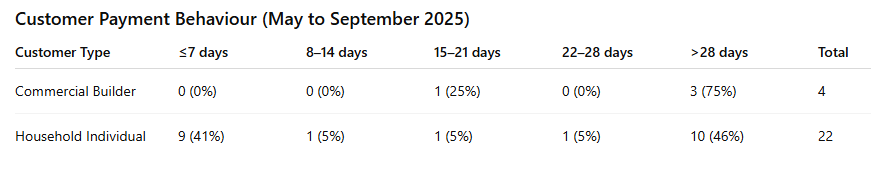

That got me digging deeper into the invoice cycle and how long it takes different types of jobs to actually pay. I broke it down into commercial jobs versus residential jobs, covering May through September.

What it shows

Households

41% paid within our 7-day window

14% paid between 8 and 28 days

46% took more than 28 days

So even in the residential space, it is not as simple as quick payers. There are really two groups — the prompt ones and the ones who sit on it for a month or more.

Commercial jobs

0% paid within 14 days

25% paid within 15 to 21 days

75% took more than 28 days

No surprises here. They run on their own cycle, usually three to six weeks, regardless of what is written on the invoice.

Why it matters

This is the heart of the cash flow squeeze. By the 20th of the month, when GST, PAYE, and supplier bills are due, a big chunk of our invoiced work still has not been paid. The work is there. The sales are there. But the cash is not.

It is a timing mismatch, and it is the difference between looking in the green on paper and actually having enough in the bank to breathe easy.

What we are planning to try

We do not just want to identify the problem, we want to fix it. Here is what we are going to test over the next few months:

Deposits on commercial jobs. Instead of waiting 30 to 45 days, we will trial 30 percent upfront, 40 percent mid job, and 30 percent on completion.

Stricter follow ups on residential jobs. If payment is not made within the 7 day window, we will start chasing earlier instead of waiting a full month.

Building a cash buffer. Our aim is to build a reserve equal to 1 to 2 months of fixed costs, so the 20th does not feel like a cliff edge every month.

At the end of the day this is not about being harsh. It is about keeping the business strong so we can keep saying yes to work, pay our people on time, and keep growing.